How The Wallace Insurance Agency can Save You Time, Stress, and Money.

Table of ContentsAll about The Wallace Insurance AgencyThe The Wallace Insurance Agency StatementsThe Buzz on The Wallace Insurance AgencyThe Wallace Insurance Agency Can Be Fun For AnyoneThe Wallace Insurance Agency Fundamentals ExplainedNot known Incorrect Statements About The Wallace Insurance Agency Some Known Incorrect Statements About The Wallace Insurance Agency The 4-Minute Rule for The Wallace Insurance Agency

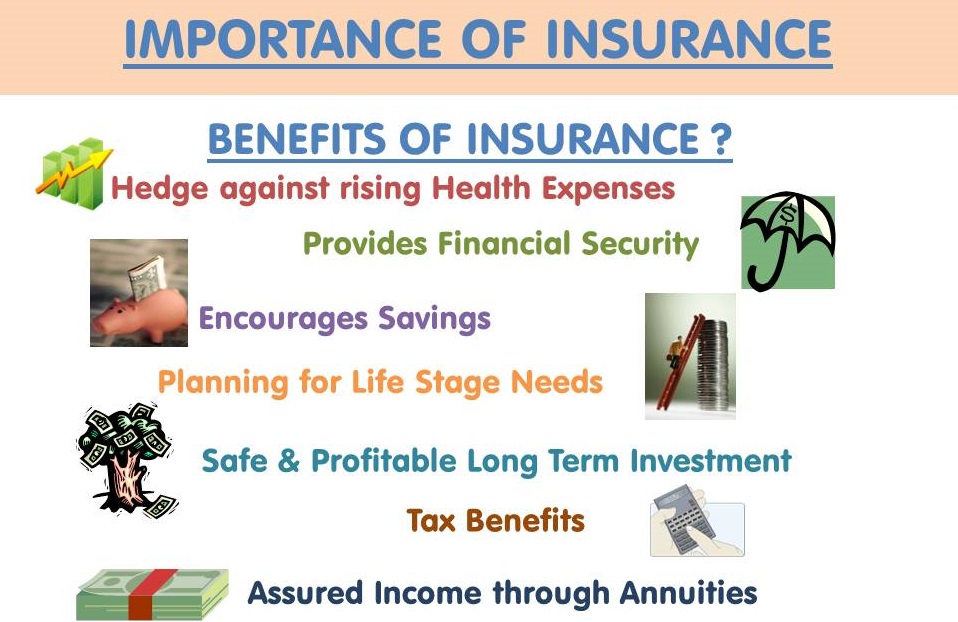

These strategies likewise use some security aspect, to help make sure that your beneficiary gets financial settlement should the unfortunate take place throughout the tenure of the plan. Where should you start? The most convenient way is to start assuming concerning your top priorities and needs in life. Right here are some inquiries to obtain you started: Are you searching for greater hospitalisation coverage? Are you concentrated on your household's wellness? Are you trying to conserve a wonderful sum for your child's education demands? Lots of people start off with among these:: Against a background of climbing clinical and hospitalisation costs, you may desire bigger, and greater protection for clinical expenses.: This is for the times when you're harmed. For example, ankle joint strains, back strains, or if you're knocked down by a rogue e-scooter motorcyclist. There are additionally kid-specific policies that cover playground injuries and conditions such as Hand, Foot and Mouth Disease (HFMD).: Whole Life insurance policy covers you forever, or usually approximately age 99. http://ttlink.com/wallaceagency1.

What Does The Wallace Insurance Agency Mean?

Depending on your insurance coverage plan, you obtain a swelling amount pay-out if you are permanently disabled or critically ill, or your loved ones obtain it if you pass away.: Term insurance policy supplies coverage for a pre-set period of time, e - Insurance coverage. g. 10, 15, twenty years. Due to the fact that of the shorter insurance coverage duration and the absence of money value, costs are usually reduced than life strategies

, and offers annual money benefits on top of a lump-sum amount when it develops. It commonly consists of insurance protection against Complete and Irreversible Handicap, and death.

The smart Trick of The Wallace Insurance Agency That Nobody is Discussing

You can select to time the payment at the age when your child mosts likely to university.: This provides you with a monthly revenue when you retire, typically in addition to insurance policy coverage.: This is a method of saving for short-term objectives or to make your cash job harder against the pressures of rising cost of living.

5 Easy Facts About The Wallace Insurance Agency Explained

While obtaining various plans will certainly offer you extra comprehensive protection, being excessively secured isn't an excellent point either. To avoid undesirable economic tension, compare the policies that you have versus this list (Insurance policy). And if you're still not sure about what you'll need, just how a lot, or the sort of insurance to get, seek advice from his response a financial consultant

Insurance policy is a long-term dedication. Always be prudent when making a decision on a plan, as changing or terminating a strategy prematurely usually does not yield monetary advantages.

8 Easy Facts About The Wallace Insurance Agency Described

The very best part is, it's fuss-free we automatically exercise your cash flows and give money suggestions. This article is meant for information just and should not be depended upon as monetary advice. Prior to making any type of decision to buy, sell or hold any kind of investment or insurance product, you must consult from a financial advisor concerning its viability.

Invest only if you recognize and can monitor your investment. Diversify your investments and avoid spending a big section of your money in a solitary item provider.

The Greatest Guide To The Wallace Insurance Agency

Just like home and auto insurance policy, life insurance policy is necessary to you and your family's financial protection. To aid, let's explore life insurance coverage in extra detail, just how it works, what worth it may supply to you, and exactly how Financial institution Midwest can assist you discover the right plan.

It will help your family settle financial debt, obtain earnings, and reach major economic objectives (like university tuition) in the occasion you're not here. A life insurance coverage plan is fundamental to planning these monetary considerations. In exchange for paying a month-to-month costs, you can obtain a collection amount of insurance coverage.

Not known Details About The Wallace Insurance Agency

Life insurance policy is right for almost every person, even if you're young. Individuals in their 20s, 30s and also 40s commonly neglect life insurance policy - https://codepen.io/wallaceagency1/pen/gOqGYar. For one, it calls for attending to an uneasy concern. Several younger people likewise assume a policy simply isn't right for them provided their age and family members situations. Opening a plan when you're young and healthy and balanced could be a smart option.

The even more time it requires to open a plan, the even more threat you encounter that an unforeseen occasion might leave your household without insurance coverage or financial assistance. Depending upon where you're at in your life, it is necessary to understand precisely which sort of life insurance policy is ideal for you or if you require any kind of at all.

Fascination About The Wallace Insurance Agency

For example, a house owner with 25 years remaining on their mortgage might get a policy of the same length. Or allow's claim you're 30 and strategy to have children quickly. Because instance, enrolling in a 30-year plan would certainly secure your costs for the following three decades.